How Smart Kx helped a new advisor set his practice up for automated success

Our new advisor connected with us when he was in the registration process for his new firm. This advisor had worked at a large RIA and managed about $80M that he expected to move over to his new firm. Like most new RIA owners, he was excited about the independence but did not have exposure to the nuances of AUM fee billing, compliance or regulatory disclosures in his previous role.

Our user faced three challenges when it came to billing. First, he didn’t know what billing methods were available or what one was best for his firm. Second, he didn’t want to fall prey to the regulator’s most common deficiency- fees. Lastly, as in any new business- time was most important. The advisor wanted to serve clients, not paperwork.

When the advisor came to us, he had already employed a compliance consultant to help him get started. He used our services to go one step deeper into the client onboarding and billing procedure.

Here is how Smart Kx helped the advisor set his firm up at the onset for efficiency and success

Finding a suitable billing method to meet goals.

A majority of firms bill quarterly in advance, solely because it is “what everyone does.” Our advisor had a hunch this may not be the best method but needed to know the ins and outs of various methods. The most important qualifications in a billing method for this advisor were:

- fairness to his clients;

- to reduce client concerns about cashflows or volatility impacting their fee;

- to easily accommodate assets moving to the advisor over time;

- implementing a “set it and forget it” automatic method; and

- to provide regular recurring cashflow to the business.

We discussed with the advisor the pros and cons of the three parts of AUM fee billing: timing, valuations, and to bill in advance or arrears. We also shared our experience working with all sizes of RIA firms and billing methods.

Based on this conversation, this advisor decided to use monthly in arrears based on the average daily balance.

Average daily balance helped smooth out the market fluctuations and eliminate worrying about cashflows. Monthly allowed him to be more comfortable with billing in arrears. Smart Kx automation ensured that he could meet the demands of billing each month.

Staying out of regulatory crosshairs.

After a billing method was selected, the advisor’s compliance team drafted his regulatory documents and his client contract. The Smart Kx team reviewed the ADV’s Item 5, the client contract and the method selected for billing to ensure all three parts were in sync.

Using our expertise in executing billing methods, we suggested updates including:

- clarifying language to ensure it properly represented the calculation method;

- additional language for how new clients would be billed during their first billing cycle; and

- eliminating unnecessary items in the initial client contract, like an IPS or client questionnaire

As part of reviewing the fee disclosure and ADV Item 5 language, we also provide all Smart Kx users a copy of our internal documentation on all math calculation methods to use for internal audit, and client and regulator inquiries.

Executing quickly.

For obvious reasons, when the advisor had a prospect that said “YES” the advisor wanted to convert the prospect to a client immediately and provide a smooth execution from onboarding to billing.

We often see that the Investment Management Agreement does not flow with the natural logistics of onboarding a new client.

For example, the agreement will require information that is not available until the accounts are moved to the advisor’s discretion. Or it will include a lengthy client investment questionnaire.

This leads the agreement to be left until the end of the process, when it should be the first thing a prospect signs.

We helped this advisor adjust the contract so that it was part of the natural flow of onboarding the clients:

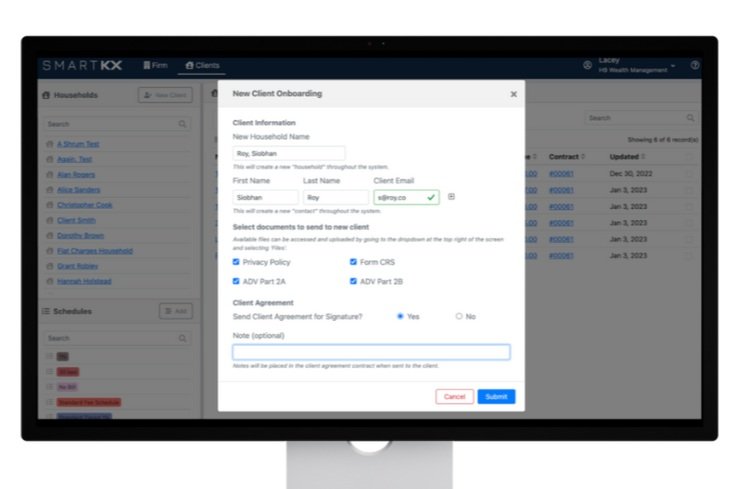

Firms using Smart Kx convert prospects to clients with a few simple clicks.

1- Prospect says yes.

2- Advisor immediately sends the regulatory documents and client contract for signature with Smart Kx.

3- Prospect is now a client, the relationship has been elevated and the advisor is no longer selling to the prospect.

4- Advisor has legal authority to act on behalf of the client; drafts custodial paperwork, investment questionnaire for the client and begins investment work.

5- Advisor sends an automated billing schedule when all account information is available.

Now the advisor can convert a prospect to a client quickly, kick off a workflow ensuring that all requirements are met and be ready to seamlessly bill when the time is right.

Using Smart Kx shortened the advisor’s response time from days to seconds, and saved him 60 minutes with each new client.

When the advisor came to us, he was faced with a sea of decisions and not much information or experience to base the decision on. Worse, without using Smart Kx, everytime he would have onboarded a new client, his stack of manual processes would grow! This would handicap his practice and put him solely in a paperwork role. He’s not in the business of paperwork, he’s in the business of giving financial advice.

Smart Kx helped the advisor:

- Shorten the conversion time;

- Build a clear and simple workflow to onboard and bill clients efficiently; and

- Reduce audit time and requirements.

Our advisor now has a seamless process in place that works for his clients and business and that is executed automatically. He is now spending time speaking with prospects and taking care of his new clients.